Shipping and logistics continue to shift rapidly as we head into the final stretch of peak season. This week brings major updates on carrier rate changes, freight market conditions, fulfillment strategy shifts, and new technology shaping multi-carrier and last-mile logistics.

We’ve pulled together the developments that matter most, along with what they mean for shippers, so you can make smarter, faster decisions during the busiest weeks of the year.

Below are the top 5 stories and how they impact your supply chain.

The Top 5 News Stories This Week

1. UPS Rate Hike Lands Early, Hitting Peak Season Budgets

UPS and FedEx have both announced 5.9% General Rate Increases (GRIs) for 2026, but UPS is implementing its increase two weeks earlier on December 22, 2025. FedEx’s changes begin January 5, 2026. Regional carrier OnTrac will raise rates 6.7% on January 3.

What It Means for Shippers

Expect an immediate cost bump during the critical final week of the holiday season.

Now is the time to:

- Re-evaluate your final-mile mix.

- Shift late-December volume to alternative carriers where possible.

- Lean into multi-carrier routing tools to protect Q4 margins.

The early UPS increase highlights why flexible carrier diversification is no longer optional.

2. Peak Season Volume Weakens, Signaling Possible Freight Recession

Despite the holidays, the market is bracing for a subdued peak season, with truckload and LTL volumes slightly below previous years. Many retailers front-loaded inventory in early 2025, leaving the market “unusually slow” for November. Experts warn that persistent overcapacity relative to demand could signal a freight recession.

What It Means for Shippers

For the first time in several peak seasons, capacity is readily available. That means:

- More predictable transit times

- Lower risk of service failures

- Stronger negotiation leverage with carriers and 3PL partners

If you have LTL or truckload needs outside of parcel, now is a rare window to secure favorable pricing and flexible terms.

3. Retailers Shift Fulfillment Strategy as Kroger Backs Off Automation

Kroger is closing three of its large automated fulfillment centers and recording a $2.6B impairment, signaling a major pivot away from hyper-automated CFCs. Instead, the grocer is doubling down on store-based fulfillment and expanding partnerships with last-mile providers like Instacart and DoorDash.

What It Means for Shippers

This is a strategic signal to the broader market:

Massive automation isn’t always the most profitable or flexible model.

Shippers should reassess:

- Whether large-scale automation truly fits their SKU mix and order profiles

- The advantages of hybrid fulfillment (in-store and warehouse)

- Opportunities to use local delivery partners to reduce cost and increase responsiveness

Efficiency is increasingly coming from flexibility, not scale alone.

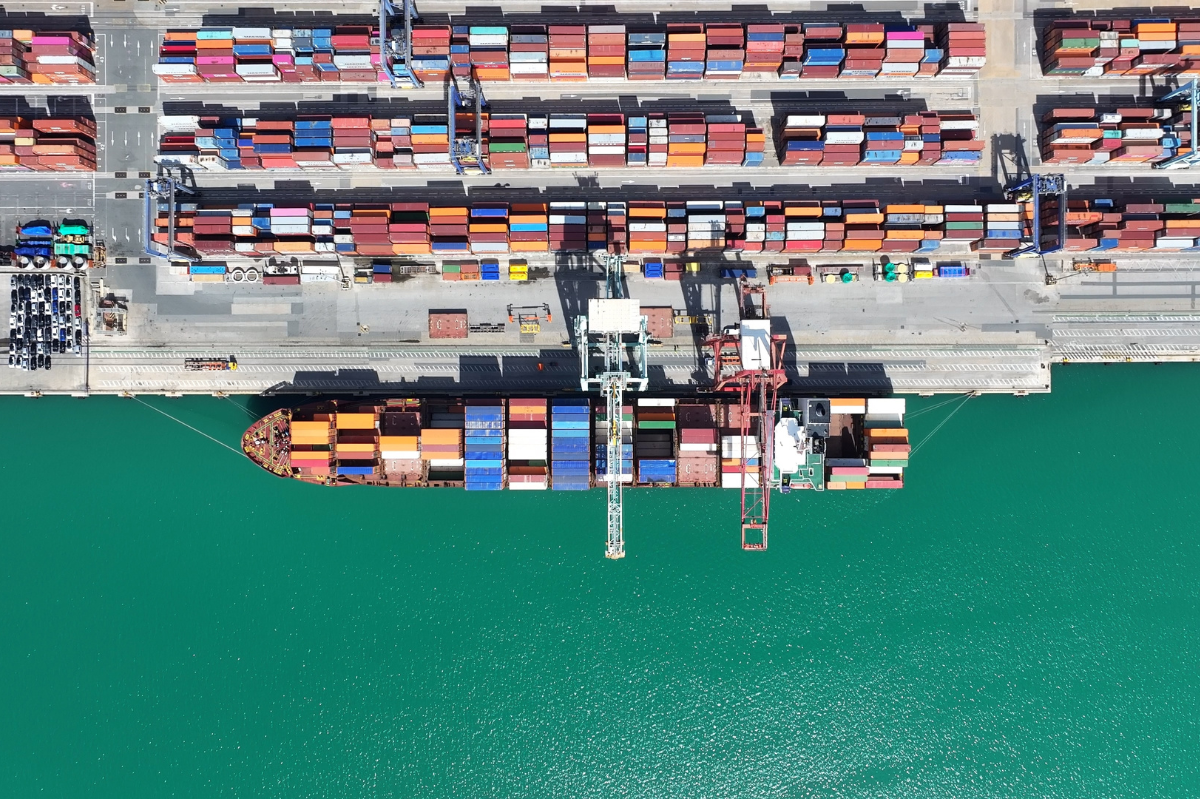

4. Ocean Freight Rates Stabilize, but Red Sea Disruptions Remain a Wildcard

Ocean rates have held relatively steady throughout November, with China–US lanes even seeing a correction following early-month GRIs. Yet geopolitical volatility, especially in the Red Sea, continues to pose an unpredictable threat to global transit times and routing.

What It Means for Shippers

Short-term stability is good news for holiday and early-Q1 inventory planning.

But the Red Sea remains a persistent risk factor.

Shippers should:

- Maintain contingency routings

- Budget for potential war-risk or emergency surcharges

- Continue monitoring transit times into Q1 2026

Even in a stable rate environment, geopolitical exposure remains high.

5. AI Platforms Accelerate Multi-Carrier and Last-Mile Optimization

New platforms are emerging to simplify multi-carrier complexity. Ship Angel is partnering with Coneksion to offer unified access to ocean carriers for booking and tracking. Meanwhile, Dispatch launched DispatchOne, an AI-powered platform for intelligent last-mile orchestration for enterprise shippers.

What It Means for Shippers

AI-driven visibility and optimization tools are no longer optional for scaling modern operations.

Benefits include:

- Automated carrier selection

- Centralized booking and tracking

- Better cost control across parcel, LTL, TL, and last mile

Shippers investing now will see fewer operational bottlenecks, and stronger margin protection, as volume spikes and carrier behavior becomes more unpredictable.

The Bottom Line

The end-of-year shipping landscape remains dynamic. Early GRIs, a cooling freight market, shifting fulfillment models, and emerging AI tools are reshaping how goods move across networks.

For shippers, the winners this peak season will be those who stay nimble:

- Diversifying carriers

- Leveraging negotiation opportunities

- Building hybrid fulfillment models

- Investing in intelligent, multi-carrier technology

Understanding what’s changing today ensures you’re better prepared, not just for the final weeks of 2025, but for the volatility and transformation coming in 2026.

Related Topics

Learn how VESYL can save you money on shipping

Not sure which plan suits you best? Have questions about our software? Contact our sales team for expert guidance.

.png)

.png)